Building a Financial Safety Net

Saving a little bit each month can make a huge impact on your financial future.

Saving money can be a challenge. It takes determination and some financial skill to keep money in the bank rather than spending it. If you’re like many educators, there are probably several reasons it’s difficult to save.

However, with a savings plan in place, you can help avoid financial worry now and in the years to come.

Set Goals & Stick to Them

Saving money is how you’ll achieve your financial goals. To make saving easier and more practical, think about setting short-term, mid-term, and long-term financial goals that move you into a financially secure future and build you a robust retirement nest egg. To keep yourself in check, put a date on the calendar (at the beginning or end of each year) to review your goals, make necessary adjustments, and celebrate your financial successes. Whatever your ambitions, start now and save consistently.

Pay Yourself First

To ensure you’re regularly putting money into savings, why not set up an automatic transfer where a portion of your earnings is diverted into a designated savings account on payday? You’re not likely to miss something you didn’t actually have on hand in the first place.

Emergency savings

Because you can’t plan and prepare for every emergency that might come your way, setting aside emergency savings will reduce some of the financial burden you may experience. Generally, your emergency savings should contain enough money to pay for three to six months of your daily living expenses. Don’t think you can save enough? Don’t worry, just start saving any amount you can. For example, let’s say you save $20 a week. At the end of two years, you’ll have saved $2,080. Increase this amount to $50 a week, and your two-year emergency savings grows to $5,200. Saving something is always better than saving nothing.

Save for Retirement

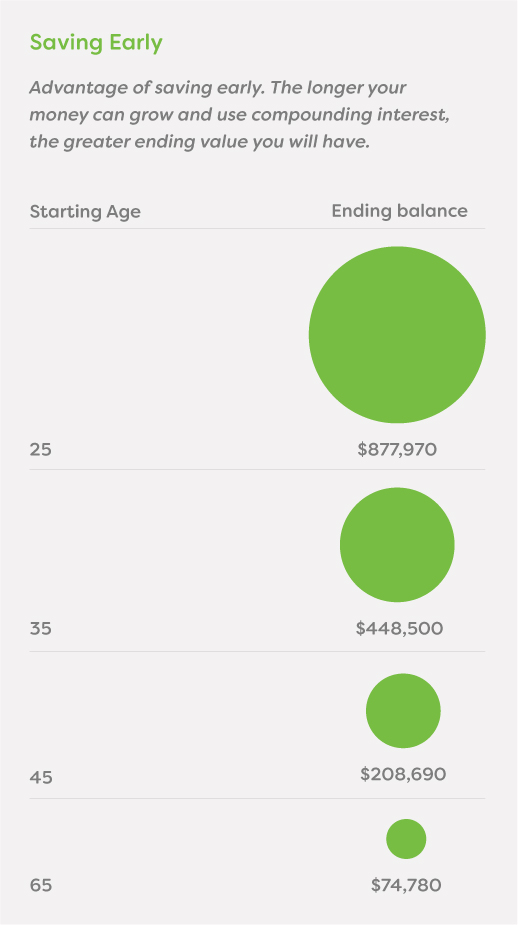

Set financial goals that allow you to put money into your retirement savings account. Making these contributions early and regularly will increase your ability to comfortably retire in the manner you’d like.

CTA offers a retirement savings plan designed for educators. You can find more information on this by visiting The Plan.