CalSTRS Retirement Benefit

As a member of the CalSTRS system, you need to understand how the program works and what benefits you will receive.

To help you make the most of this valuable defined benefit pension plan, we’ve provided some helpful highlights.

What is CalSTRS?

CalSTRS is a traditional defined benefit plan that provides retirement, disability, and survivor benefits for California public school educators. Your retirement benefit is based on a formula set by law, so it is important to understand how your benefit is calculated.

Calculating your benefits

The California Public Employees’ Pension Reform Act of 2013 (PEPRA) significantly changed the benefits structure of CalSTRS. The benefit structure now depends on whether you were hired to perform CalSTRS creditable activities before or after January 1, 2013.

CalSTRS 2% at age 60

For those first hired on or before December 31, 2012, this is the formula for calculating a member-only defined benefit:

Age factor

This is the percent of final compensation to which you are entitled for each year of service credit, determined by your age on the last day of the month in which your retirement is effective.

Age factor is set at 2% at age 60

The age factor is decreased if you retire before age 60 and increased to a maximum of 2.4% if you retire later than age 60. If you retire with at least 30 years of earned service credit, a 0.2% career factor will be added to your age factor, up to a maximum age factor of 2.4%.

Service credit

This is the accumulated period of time, in years and partial years, during which you receive creditable compensation for service as a member of the Defined Benefit Program. You may be able to purchase service credit or receive additional credit for unused sick leave.

Final compensation

This is calculated using the highest average salary for three consecutive school years, unless you have 25 or more years of qualified service credit. If you have 25 or more years of service credit, the highest 12 consecutive months of compensation will be used in your benefit calculation. If you had at least 30 years of qualified service credit by December 31, 2010, you may be eligible for a longevity bonus that adds a set dollar amount to your monthly benefit.

Visit CalSTRS.com/annuity-calculation-estimates for the most up-to-date information.

CalSTRS 2% at age 62

For those first hired on or after January 1, 2013, no career factor is considered when calculating a member-only defined benefit. The formula is:

Age factor

The age factor is set at 2% at age 62.

The age factor is decreased if you retire before age 62 and increased to a maximum of 2.4% if you retire at age 65. There is no career factor for those hired on or after January 1, 2013.

Service credit

This is the accumulated period of time, in years and partial years, during which you receive creditable compensation for service as a member of the Defined Benefit Program.

Final compensation

This is calculated based on the highest average annual salary for three consecutive school years, regardless of years of service credit.

How much can you expect at retirement?

CalSTRS calculates that the median benefit paid to members who retired in 2011–12 replaced 54 percent of their highest salary. This is known as the replacement ratio. Consider whether you would be comfortable living on 54 percent of your current income.

For members hired on or after January 1, 2013, who are subject to the 2% at age 62 formula, PEPRA will reduce the replacement ratio. CalSTRS estimates that the replacement ratio will be about 47 percent of their highest three years' salary, assuming the future member’s age and service at retirement is the same as for recently retired members.*

What happens to my CalSTRS account if I change jobs?

If you change employment from a job covered by one system to employment covered by the other system, you may be able to choose whether to remain with the previous system or switch to the new one. If the new position is covered under a new retirement system, you must submit a Retirement System Election form to your employer within 60 days of your hire date if you wish to stay with your current retirement system. If you move to the new system, you have two options:

- You can decide to have dual membership by keeping your account with the old retirement system and having your new job under the new retirement system. In this case, you could retire from both systems at the same time for a concurrent retirement. There are restrictions on this option, so be sure to contact CalSTRS or CalPERS for more information.

- You can take a refund of your contributions in your old system. Again, you need to find out what the restrictions are by contacting CalSTRS or CalPERS before making this decision. Caution: If you take a refund, you forfeit rights to retirement benefits under the system from which you took the refund.

If you do nothing, you will automatically become a member of the retirement system that covers your new position.

Resources

Because it's important to learn how your CalPERS benefits are calculated and what the impact of changing jobs may be on your benefits, here are some helpful websites to consult:

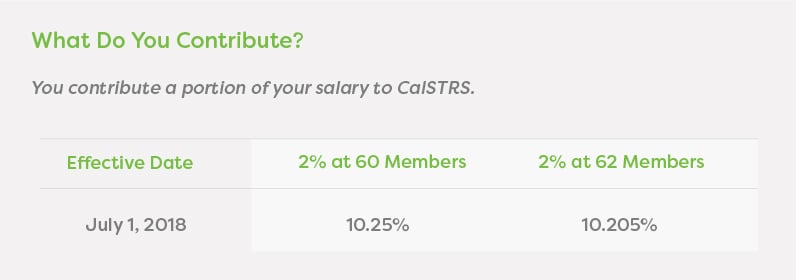

For information on your contributions to CalSTRS: https://www.calstrs.com/calstrs-2014-funding-plan

For information on plan benefits: https://www.calstrs.com/defined-benefit-program

*Source: CalSTRS, www.calstrs.com/funding-future, “Sustaining Retirement Security for Future Generations: Funding the California State Teachers’ Retirement System,” February 2013, CalSTRS.