Chapter Insurance Program

CTA Chapter Insurance Program Prepared by CTA Risk Management Department

TABLE OF CONTENTS

AUTOMATIC COVERAGE FOR CHAPTERS

General Liability Insurance

Certificates of General Liability Insurance

Excess Business Automobile Liability

Renting a Vehicle While on CTA Business

NEA Fidelity Bond Program

NEA Association Professional Liability (APL) Insurance

Important Coverages for Chapters:

- Property and General Liability

- Employment Practices Liability

- Network Security and Privacy Liability

- Workers’ Compensation

- Directors’ and Officers’ Liability

- Fiduciary Liability

Contracting with a Transportation/Bus Company

NEA Educators Employment Liability (EEL) Insurance

NEA EEL Medical and Related Arts (MR&A) Endorsement

Sabbatical Leave Bond

CHAPTER FINANCIAL RESPONSIBILITIES AND CONSIDERATIONS

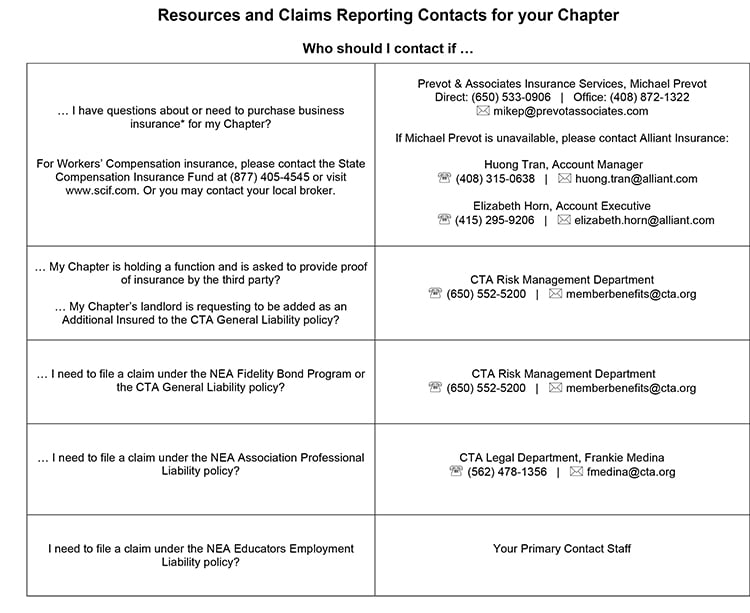

RESOURCES AND CLAIMS REPORTING CONTACTS FOR YOUR CHAPTERS

----------

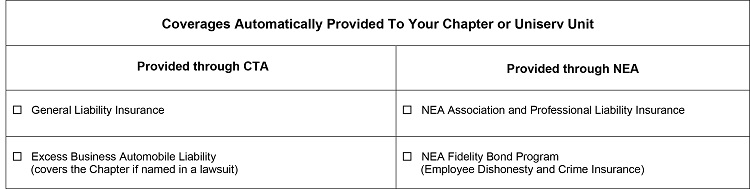

Chapter Insurance Checklist

Please use this checklist as a tool to assess what insurance coverage is automatically provided to your chapter or UniServ Unit through CTA and NEA, and what coverages you are responsible for on your own. You will also find a list of coverages available to CTA members.

----------

Automatic Coverages for Chapters

CTA purchases several business insurance policies for chapters and UniServ Units. These policies are designed to protect the chapters or UniServ Units from losses incurred as a result of accidents or negligence while operating the local organization or rendering professional services on behalf of the organization.

The purchasing of these insurance policies with appropriate limits, deductibles, and coverage is part of CTA’s risk management program and may be subject to change due to varying market conditions and availability of coverage. This section gives a brief overview of the current insurance policies provided to chapters and UniServ Units. These policies include the following:

- General Liability Insurance

- Excess Business Automobile Liability Insurance

- NEA Fidelity Bond Program

- NEA Association Professional Liability (APL) Insurance

The information provided is intended only as a brief summary. In every case, the actual policy contract is subject to various definitions, limitations and exclusions that are not mentioned herein.

Please read the actual policies for full coverage detail.

----------

GENERAL LIABILITY INSURANCE (No premium for chapters)

CTA’s Commercial General Liability (CGL) policy provides defense and indemnification for losses and expenses resulting from bodily injury and/or property damage from an accident incurred by third parties that allege negligence by CTA, a CTA chapter, or UniServ Unit. CGL covers chapters or UniServ Units up to $1 million per occurrence against liability claims for bodily injury and property damage. The annual aggregate limit of coverage for all claims which may occur during the policy year at any one location is $2 million. However, CTA has purchased an excess policy that provides coverage above the primary general liability policy’s limit of insurance.

If your chapter or UniServ Unit leases office space, your chapter is covered under CTA’s General Liability policy. If your landlord is requesting proof of insurance, you may obtain a certificate of insurance by emailing CTA’s Risk Management Department at RiskManagement@cta.org. If CTA’s policy does not meet your landlord’s requirements, you may need to purchase your own business insurance policy for your chapter or UniServ Unit. Please contact CTA’s Risk Management with any questions.

If you own your building, you must purchase a separate General Liability policy.

Some of the specific features of the policy include the following:

BODILY INJURY AND PROPERTY DAMAGE LIABILITY

This coverage provides defense and/or settlement payments if a local chapter or UniServ Unit, or an employee of a chapter or UniServ Unit, is alleged to be, or is proven to be, liable for negligently causing bodily injury to a third party, or damage to a third party’s property, including fire and water damage.

This policy has a $1 million per occurrence limit, which is also subject to an annual aggregate limit of $2 million per location. An example of a bodily injury claim would be a lawsuit in which a third party (such as a visitor or guest) was injured at a chapter function and sued the chapter for negligently causing their injury. However, bodily injury liability does not apply to a work-related injury to an employee of the chapter or UniServ Unit. This would be considered a workers’ compensation claim and would be covered under a workers’ compensation policy which the chapter or UniServ Unit is responsible for purchasing.

Also, coverage for property damage does not apply to property that is owned, rented or leased, or in the care, custody or control of a local chapter or UniServ Unit (see “For Chapter-Leased Buildings” below).

FOR CHAPTER-LEASED BUILDINGS - LEGAL LIABILITY COVERAGE FOR DAMAGE TO LEASED PREMISES

This coverage provides payment to the landlord for damage to chapter or UniServ Unit-leased premises due to the chapter’s or UniServ’s negligence. This coverage has a $1 million limit at any one premises and a $2 million annual aggregate. For example, if fire damage occurs in a chapter or UniServ Unit-leased office, this coverage would respond for the damage to the leased portion of the premises which is in the chapter or UniServ Unit’s care, custody, and control, if the chapter negligently caused the damage and if the lease does not include a mutual waiver of subrogation.

KEY LEARNING POINTS

- General Liability provides coverage for claims by third parties (non-employees) who may allege Bodily Injury or Property Damage, that occurred as a result of your activities or your operations.

- $1 million per occurrence/$2 million annual aggregate per location - subject to an overall $5 million policy aggregate - including Products and Completed Operations. - Damage to Leased Premises coverage.

- $1 million limit applies to any one premises while rented to you.

----------

CERTIFICATES OF GENERAL LIABILITY INSURANCE FOR CHAPTER EVENTS

If your chapter or UniServ Unit has an off-site function, the venue may ask you to provide proof of general liability insurance. If you are asked to add a third party as an Additional Insured or provide proof of insurance, please contact the CTA Risk Management Department at (650) 552-5200. A fee may be incurred when adding a third party as an Additional Insured for a specific event. To obtain a copy of the CTA general liability certificate of insurance, click on “Chapter Insurance” under “Tools & Resources” at www.CTAMemberBenefits.org.

Note: Some third parties may require an additional insurance provision referred to as "Primary and Non Contributory". This type of clause transfers all risks of the event to CTA's general liability policy even if CTA is not negligent. If this clause is included in the contract, please ask the vendor to remove it. If the clause cannot be removed, please contact the CTA Risk Management Department at (650) 552-5200 to discuss this further.

Some venues may have terms in their contract that require CTA to assume risks beyond our control. If your venue has this language in its contract, your chapter or UniServ Unit may need to purchase a one-day Special Event policy.

Back to top----------

EXCESS BUSINESS AUTOMOBILE LIABILITY (No premium for chapters)

The Business Automobile Liability policy protects CTA, the local chapters and UniServ Units against claims for bodily injury and property damage liability brought by third parties resulting from an auto accident involving local chapter employees, leaders, and CTA members while driving their own vehicle for CTA, local chapter and UniServ Unit business. This is a business auto liability policy and therefore there is no coverage for the driver as liability coverage is provided by the driver’s personal auto policy. There is no coverage for physical damage to any personally owned automobile. Coverage does not apply to automobiles that are owned by the chapter or UniServ Unit. Vehicles owned by a local chapter or UniServ Unit should have a separate business auto policy. The business auto policy does not provide coverage for medical payments or uninsured/underinsured motorists for accidents involving any non-owned or hired automobile. This must be covered by the owner’s personal automobile policy, along with physical damage coverage, which includes comprehensive and collision coverages for the personally owned automobile.

CTA recommends that all drivers, whether they are driving on CTA business or for pleasure, to carefully evaluate the liability limits/coverage in their personal auto policy. The California Minimum Liability Insurance required limits are $15,000 for property damage coverage (property damage to others) and 30/60 ($30,000 per person and $60,000 total coverage per claim) for bodily injury coverage (injury to others). CTA strongly recommends higher limits of at least $100,000 for property damage coverage and 300/500 ($300,000 per person and $500,000 total coverage per claim) for bodily injury coverage.

CTA’s Business Auto Policy is not designed to cover all potential users in all potential situations. Please consult with the Risk Management Team should you have any questions regarding use of a personally owned or rented automobile on CTA business.

Back to top----------

RENTING A VEHICLE WHILE ON CTA BUSINESS

The CTA Business Automobile Liability policy protects CTA, the local chapters, and UniServ Units when a vehicle is rented for CTA business. Again, there is no coverage for the individual driver who is renting a vehicle on CTA business. Therefore, CTA chapter leaders and members who rent a vehicle for CTA business should check with their own personal auto insurance carrier regarding coverage when renting a vehicle. When a CTA chapter leader or member rents an automobile for CTA business, he or she should state on the rental agreement that he or she is on CTA business, in order to protect CTA and the local chapter or UniServ Unit. The business auto policy does not provide coverage for medical payments or uninsured/underinsured motorists to the driver of a non-owned or rented automobile. This must be covered by the driver’s personal automobile policy or purchased directly from the rental car company.

Renting a vehicle for CTA business use requires prior approval from the CTA Secretary-Treasurer.

Back to top----------

NEA FIDELITY BOND PROGRAM (No premium for chapters – deductibles may apply)

The NEA Fidelity Bond Program consists of three policies: Labor Organization Bond, Employee Dishonesty, and Crime Insurance. The Labor Organization Bond and Employee Dishonesty Policy covers fidelity losses due to a chapter’s officers or employees impropriety. The Crime Insurance Policy covers the theft of money or securities by a non-employee. The NEA Fidelity Bond Program provides coverage to state and local affiliate political action committees. It does not cover insurance trusts or pension plans, or other funds created by state or local affiliates. All potential claims must be reported at the earliest practicable moment after discovery of any potential loss, regardless of the dollar amount involved in the potential loss.

Coverage under the NEA Fidelity Bond Program is subject to the entire wording of the Program policies.

LABOR ORGANIZATION BOND AND EMPLOYEE DISHONESTY POLICY

The Labor Organization Bond and Employee Dishonesty Policy are tiered policies that protect the chapter against loss of money or securities due to fraud or dishonesty of an officer or employee. In some cases, losses due to a consultant’s fraud or dishonesty are covered as well. The Labor Bond, which serves as the primary insurance layer, provides coverage up to $500,000 per loss/per employee. If the primary layer is not sufficient to cover the officer or employee dishonesty loss, the Employee Dishonesty policy is triggered as a secondary layer to provide additional coverage up to the limit of liability not to exceed $1 million per claim and carries a $500,000 deductible. The $500,000 deductible for the Employee Dishonesty Policy is met through the underlying primary Labor Organization Bond policy. The Labor Organization Bond includes coverage up to $25,000 for reasonable expenses incurred and paid to an independent service provider for investigative costs, which includes costs for bank records and bank-issued copies of canceled checks, bank-issued photocopies of signature cards, and costs and fees for forensic audits. This expense coverage is applicable to substantiated losses greater than $50,000; including coverage for losses greater than $50,000 when the accused makes restitution resulting in a net loss less than $50,000.

CRIME INSURANCE POLICY

The Crime Insurance Policy protects the chapter against theft of money or securities by a non-employee in or away from the chapter or UniServ Unit. The Crime Insurance Policy consists of premises coverage, transit coverage, depositor’s forgery coverage, money order and counterfeit currency coverage, and computer theft or funds transfer fraud coverage. There is a $1,000 deductible per loss. Premises coverage protects against the theft of money or securities on the premises, usually by robbery or burglary. Transit coverage protects against money or securities theft outside the association’s premises and during transit from one location to another. Depositor’s forgery coverage specifically insures against forgery or alteration of bank drafts. Money order and counterfeit currency coverage protects the chapter or UniServ Unit when a fraudulent money order is accepted by the chapter or UniServ Unit in good faith. Computer fraud or funds transfer fraud coverage covers direct losses by computer fraud or funds transfer fraud of money or securities. Enhanced coverage for “Impersonation Fraud” provides coverage for all affiliated locals up to $20,000 for a loss resulting from fraudulent instructions. These fraudulent instructions are initiated by someone posing as a person of authority, a vendor, or other trusted individual and directs or manipulates an officer/employee to transfer, pay or deliver funds from the chapter’s account without the chapter’s proper authorization. (Note: a $1,000 deductible applies when invoking this endorsement.)

IMPORTANT NOTIFICATION REQUIREMENTS

The discovery of any potential fidelity loss due to officers’ or employees’ dishonest acts, or due to theft by a non-employee, must be reported to CTA at the earliest practicable moment after discovery of any potential loss, even if the potential loss is at or below $1,000. If warranted, CTA thereafter reports the potential loss to NEA. Proof-of-loss documentation must be submitted within four months after the initial discovery of any potential loss. Documentation must include a tally itemizing and totaling the loss, copies of bank records and checks, and other such items documenting the circumstances of the loss.

KEY LEARNING POINTS

- The Labor Organization Bond and Employee Dishonesty Policy are tiered policies that provide coverage for a chapter or UniServ Unit if its funds or securities are stolen in a variety of ways by an officer or employee. Maximum combined coverage of $1.5M.

- The Crime Insurance Policy provides coverage for a chapter or UniServ Unit for stolen funds or securities by a non-employee that occurs either in or away from the chapter office or UniServ Unit.

- A $1,000 deductible per loss applies under the Crime Insurance Policy; a $1,000 deductible applies for losses covered by the Impersonation Fraud Endorsement.

- Notify CTA, and thereafter NEA is to be notified, as soon as practicable after discovery of any potential loss, regardless of the dollar amount involved in the potential loss.

- Proof-of-Loss documentation is required to be submitted within four (4) months after discovery of a covered loss.

----------

NEA ASSOCIATION PROFESSIONAL LIABILITY (APL) INSURANCE (No premium for chapters)

This policy protects local chapters, UniServ Units and their officers, chapter leaders and employees for payment of monetary damages as a result of a claim or a lawsuit arising out of their authorized association activities. Some examples include breach of duty, neglect, error, misstatement, misleading statement and act or omission in the course of authorized association activities. Coverage under this policy is $1.5 million per occurrence with a $10 million maximum annual aggregate. Attorney fees and other defense expenses are paid in part by NEA and the union defendant(s). CTA will file claims for chapters under the policy and will ensure chapters receive NEA’s contributions towards chapters’ defense costs. This policy excludes employment practices claims. It also excludes criminal acts and claims not seeking monetary damages. An example of a covered claim would include a CTA member who files a duty of fair representation claim seeking monetary damages against the chapter alleging that his or her grievance was mishandled.

Coverage under the NEA APL Program is subject to the entire wording of the Program and insurance policy.

For more details, please see section, “Resources and Claim Reporting Contacts for your Chapter”.

Back to top----------

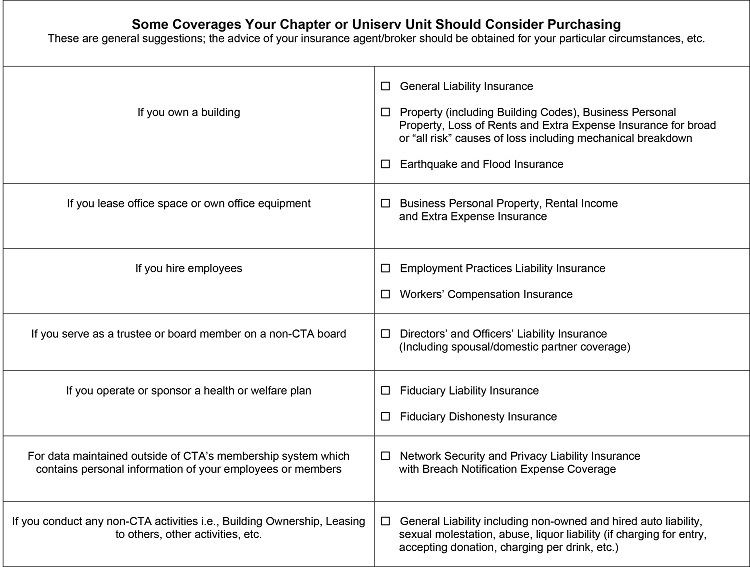

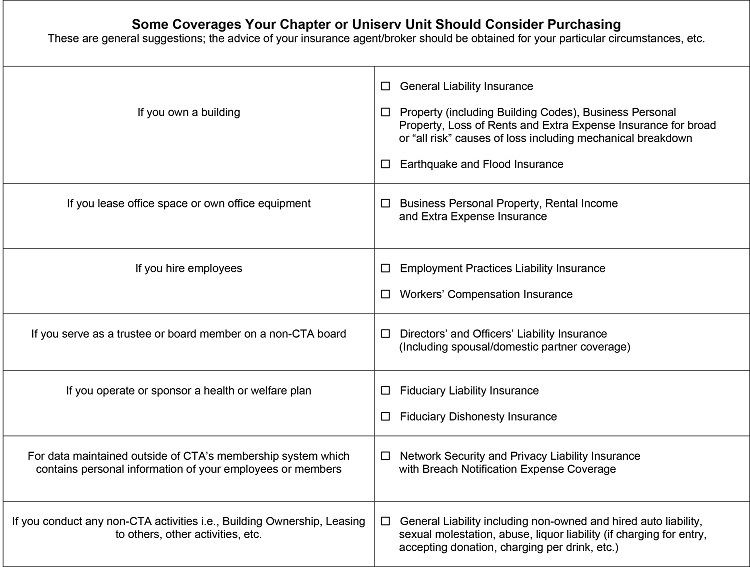

Chapter Insurance Options

Chapters or Uniserv Units should consider purchasing several insurance coverages. Some coverages are required by state regulation and other coverages may be required by lenders. Here is a list to assist you:

----------

PROPERTY AND GENERAL LIABILITY INSURANCE – FOR CHAPTER-OWNED BUILDINGS

Chapters or UniServ Units that own their buildings must purchase both general liability and property coverage. The coverage you purchase should be comprehensive. Ideally, the property policy will cover your buildings, business personal property, rental income protection and extra expenses which you may incur as a result of leasing or renting temporary space while your building or office is being repaired or replaced. You may also want to consider an earthquake and/or flood insurance policy.

Back to top----------

EMPLOYMENT PRACTICES LIABILITY INSURANCE – FOR CHAPTERS THAT HIRE EMPLOYEES

Chapters or UniServ Units should be aware of the potential for costly employment-related litigation. Employment litigation is one of the fastest growing areas of law; therefore, we encourage all chapters that hire employees to purchase Employment Practices Liability Insurance coverage. These policies provide coverage for defense costs and settlements for lawsuits and Equal Employment Opportunity Commission (EEOC), actions alleging discrimination, sexual harassment, wrongful termination as well as other alleged common-law violations that may occur as a result of the employer/employee relationship. These policies may also include coverage for sexual discrimination and/or harassment claims brought by non-employees. Please check with your agent/broker accordingly.

Back to top----------

NETWORK SECURITY AND PRIVACY LIABILITY INSURANCE – WITH BREACH NOTIFICATION EXPENSE COVERAGE (CYBER LIABILITY)

If your chapter maintains data outside of CTA’s membership system which contains personally identifiable information of individuals, a Cyber Liability policy should be considered.

Cyber Liability insurance is an important coverage for any organization that collects and/or maintains personally identifiable information of individuals, particularly those residing in California. California has strict regulations regarding the use, maintenance and protection of personal data. Whether personal data is collected electronically or by paper, it is of the upmost importance to keep that data safe and secure. An organization can be subject to significant fines and penalties in the event a breach in your network’s security takes place and personally identifiable information is accessed by unauthorized individuals. Cyber Liability insurance will provide defense costs for potential regulatory fines and penalties arising from the inadvertent disclosure of personal data.

Additionally, it is important to train employees, board members and others in detecting and preventing phishing attacks and other types of social engineering schemes. Most network security breaches arise out of malicious email attacks and phishing schemes. Therefore, a major component in mitigating the threat of phishing attacks is educating staff on how to recognize fraudulent emails.

If you have any questions regarding safeguards and membership data, please contact the CTA Membership Department at (650) 552-5278. For any questions regarding network security and privacy liability coverage, please contact the CTA Risk Management Department at (650) 552-5200.

Back to top----------

WORKERS’ COMPENSATION – FOR CHAPTERS THAT HIRE EMPLOYEES

State law requires that all employers provide this coverage for full and part-time employees. Local chapters and UniServ Units that hire employees are required to obtain a workers’ compensation policy. Failure to do so may result in significant fines or other penalties. UniServ Associate Staff and/or an Executive Director employed directly by the chapter should be covered by a workers’ compensation policy purchased by the UniServ Unit or the chapter. To receive more information, please contact the CTA Risk Management Department at (650) 552-5200 or contact the State Compensation Insurance Fund at (877) 405-4545 or visit their website at www.scif.com.

Back to top----------

DIRECTORS' AND OFFICERS' LIABILITY INSURANCE – FOR CHAPTERS THAT SERVE AS A TRUSTEE OR BOARD MEMBER ON A NON-CTA BOARD

If the chapter or UniServ Unit has members serving on outside boards or organizations, it should verify that the outside entity has a Directors' and Officers' Liability policy. If you need additional information, Prevot & Associates Insurance Services might be able to assist you. Contact Michael Prevot at (650) 533-0906 or via email at mikep@prevotassociates.com.

Back to top----------

FIDUCIARY LIABILITY AND FIDUCIARY DISHONESTY INSURANCE – FOR CHAPTERS THAT OPERATE OR SPONSOR HEALTH OR WELFARE PLANS

Many chapters or UniServ Units operate, sponsor or participate in various employee benefit plans. Some chapters have members who serve as trustees or administrators of some type of employee benefit plan. It is important that the sponsoring organization, whether it is a trust or the chapter, purchase a fiduciary liability policy to protect the trustees, board members and employees who may be charged with violating their fiduciary responsibilities. Fiduciaries are held personally liable for their negligence in the performance of their duties as plan fiduciaries. To inquire about a policy, Prevot & Associates Insurance Services might be able to assist you. Contact Michael Prevot at (650) 533-0906 or via email at mikep@prevotassociates.com.

Back to top----------

CONTRACTING WITH A TRANSPORTATION/BUS COMPANY

Contracting with a transportation/bus company can create serious liability issues for CTA, your chapter or UniServ Unit, and officers. The CTA Risk Management Department is available to assist you in vetting a transportation company that meets safety standards and complies with insurance and other contract requirements. Please call the CTA Risk Management Department at (650) 552-5200 or email RiskManagement@cta.org for assistance.

Back to top----------

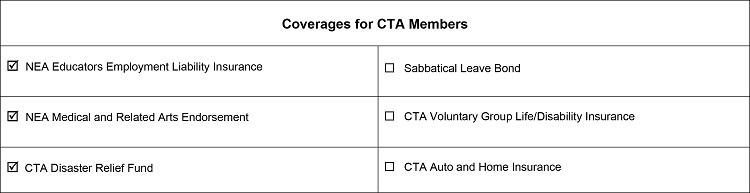

Coverage for CTA Members

This section outlines three insurance policies that protect CTA members. These include the NEA Educators Employment Liability policy and the Medical Arts Endorsement for nurses, occupational therapists, physical therapists, dental hygienist and athletic trainers. In addition, CTA’s business insurance broker, Alliant Insurance Services, can assist CTA members in obtaining a Sabbatical Leave Bond.

Back to top----------

NEA EDUCATORS EMPLOYMENT LIABILITY (EEL) INSURANCE (No premium for chapters)

CIVIL LAWSUITS

This policy provides payment of up to $1 million in damages and up to $3 million in legal defense costs per occurrence for civil lawsuits against CTA members for alleged acts arising out of their educational employment. There is a $9 million annual aggregate for legal defense costs. For example, the policy will cover a teacher who is sued by parents for negligent supervision on the school playground where their child was injured. The policy also covers civil rights cases up to $300,000 including the cost of defense, settlements, or judgments.

The policy offers defense expenses up to $5,000 for each occurrence of bodily injury, other than to another insured under the policy, caused by fungus, mold, mildew or yeast for which an insured has potential civil liability under the policy. This $5,000 sub-limit is not available for attorney fees reimbursement for defense in a criminal proceeding under the policy.

CRIMINAL CHARGES

This policy provides reimbursement for attorney fees and other legal costs if a CTA member is charged with a criminal offense arising out of his or her educational employment, provided that the CTA member is exonerated of all charges, all charges are withdrawn or dismissed, or the criminal investigation by a law enforcement agency is concluded without charges being filed. CTA members are covered up to $35,000 against any criminal proceeding, with no limitation on the aggregate number of proceedings against any member.

One scenario might be the following: A student accuses a CTA member of sexual misconduct. The CTA member denies the allegation and maintains his or her innocence. The police investigate criminal charges and the CTA member is found exonerated of all charges. The EEL policy would reimburse the CTA member for the attorney fees when incurred in the defense against the charges, according to the specific terms of the policy.

If the criminal proceeding is the result of charges arising from educational employment activities alleging corporal punishment, reimbursement up to $35,000 will be made regardless of the outcome of the case. The EEL policy also pays up to $1,000 for a bail bond and up to $500 for personal property damaged as a result of an assault upon a CTA member on school property or during an authorized school activity, subject to the specific terms of the policy.

Coverage under the NEA EEL Program is subject to the entire wording of the Program and policy. Please see section titled, “Resources and Claim Reporting Contacts” for more details.

Back to top----------

NEA EEL MEDICAL AND RELATED ARTS (M&RA) ENDORSEMENT (No premium for members)

The Medical & Related Arts Endorsement (Coverage E) provides coverage for the rendering, teaching, and supervising activities of nurses, occupational therapists, physical therapists, dental hygienists and athletic trainers. This coverage is provided to all applicable members effective September 1, 2019, without the assessment of an additional premium for coverage. It is the state affiliate’s responsibility to verify membership in a category that qualifies the Insured for coverage under the M&RA Endorsement. For any questions pertaining to this policy, please contact the CTA Legal Department at (650) 552-5425.

Back to top----------

SABBATICAL LEAVE BOND (Premium paid by CTA member)

A sabbatical leave bond is a surety bond that provides a financial guarantee to the school district that a CTA member who is on a sabbatical leave will return to the school district. Sabbatical leave is negotiated by the local chapter and is part of the local collective bargaining agreement. According to California Education Code Section 44966, sabbatical leave may not exceed a one-year period. Leave can be taken for one continuous year, two six-month periods or four separate quarters. CTA members must have rendered at least seven years of service with the district in order to be eligible for a sabbatical leave. CTA members who are interested in taking a sabbatical leave need to provide proof of a sabbatical leave bond. CTA members should contact their local school district to obtain the amount of the bond and the terms required. To obtain an application for a sabbatical leave bond, please contact Huong Tran, Account Manager, Alliant Insurance Services at (408) 315-0638 or at Huong.Tran@alliant.com. Generally, the fee for the bond is $15 to $20 per thousand dollars of coverage. For example, the fee for a $40,000 bond would be $600 per year.

Surety bonds differ from insurance in some important respects. In the case of the sabbatical leave bond, the CTA member, and the Surety company each guarantee to the school district, to the full amount of the bond, that the CTA member will comply with all terms and conditions of the leave and the applicable sections of the California Education Code. The CTA member must also indemnify the Surety company for any losses, expenses, etc. associated with the issuance of the bond. When applying for the bond, the CTA member will go through a credit analysis process and will be required to provide evidence that they qualify for the bond amount in a manner similar to qualifying for a loan of an equivalent amount. The application will also include an indemnity agreement section wherein the obligations the CTA member has to the Surety company are established.

Back to top----------

Chapter Financial Responsibilities and Considerations

CTA provides an affiliate support program aligned with the CTA Strategic Plan designed to offer assistance and leadership development from the CTA Business Division and Regional Services to work with local leadership in regard to fostering good business practices. Policies and procedures are discussed, and recommendations are brought forth to enhance the financial management of local associations.

FOR EXECUTIVE OFFICERS:

Local leaders have the following financial responsibilities to their members and local association:

- Fiduciary Responsibility – Includes making decisions that are in the best interest of its members; exhibiting due care and diligence in identifying and evaluating issues that are relevant to the local association; and governing objectively, professionally, honestly and with integrity.

- Internal Controls – Work with the Treasurer to act as custodians for the safekeeping of association funds and to maintain an accurate accounting of records. Take an active role and responsibility in a checks and balance system to protect the local’s assets, approve and implement Board procedures and distribute Representation Council policies.

- Regulatory Agencies – Comply with regulatory agency laws and filing requirements to keep in good standing and to ensure the viability of the local association.

FOR TREASURERS:

For additional and detailed information on the Treasurer’s financial responsibilities, please refer to the CTA Treasurer’s Handbook. The Handbook is designed as a reference manual for the Treasurer who oversees the financial affairs of the local association. The Treasurer’s role includes providing guidance to implement good financial business practices and proper utilization of association funds, complying with filing requirements from regulatory agencies and avoiding having to file fidelity bond claims. A brief introduction to each section in the Handbook is summarized below:

- Fiduciary Duties and General Responsibilities of a Financial Representative – This section provides an overview of the fiduciary duties of chapter leaders and notes how it is different from the duty of fair representation. This section also outlines the general responsibilities of the Treasurer including supervising the receipt and disbursement of all funds, having official custody of all funds and property, presiding over the preparation of the annual budget, and preparing and distributing periodic financial reports accordingly.

- Checklist of Deadlines – A list of deadlines by calendar date to assist local Treasurers to file required reports on a timely basis in accordance with the requirements from regulatory agencies.

- Business Practices and Internal Controls – Designed for the Treasurer to work with the Executive Board in an inclusive and interactive environment to develop, document and maintain proper internal controls and good business practices. This section includes topics of concern such as credit cards and online banking, and a checklist for an affiliate to evaluate its own business practices as well as implement internal controls.

- Budget – A Budget is a financial plan of action for your local organization. The Executive Officers, with the Treasurer as the chairperson, should approve and implement an annual budget program. The program should be designed to encourage inclusive involvement and participation from a diverse representation of your membership. The annual process includes the selecting of budget committee members, developing a calendar, holding budget forums, preparing a budget, and then culminating with the recommendation of a balanced budget to the Board of Directors followed by the subsequent adoption by Representation Council for implementation the following fiscal year. The budget should be monitored to actual expenses and be evaluated on the effectiveness based on the local's goals and objectives.

- Annual Information Tax Returns – Labor Organizations recognized by the Internal Revenue Service (IRS) under Section 501(c)(5) as tax-exempt organizations are required to file federal and state information returns. Members of the public rely on these information returns as the primary source of financial data on tax-exempt organizations. The IRS has recently implemented a new reporting regulation that requires all federal tax information returns be filed electronically.

- Political Action – CTA affiliates actively involved in local candidate and school bond, or parcel tax elections, should be aware of the regulations imposed by the Fair Political Practices Commission (FPPC), the Internal Revenue Service (IRS), and the Franchise Tax Board (FTB) regarding the disclosing of receipts and disbursements for political action.

- Service Center Councils – This section is designed for Service Center Council Treasurers and includes the annual funding schedule and requirements, the Service Center Council forms and instructions, and information on tax filing responsibilities.

- UniServ – The CTA and NEA established the Unified Staff Service Program to provide members and locals with professional staff. There are three models: Option I, Option II and RRC. This section also includes budgeting information and the calendar for forming a new Option I Unit.

- Membership – Instructions and links to resources pertaining to membership processing and remittance are provided in this section.

The Treasurers Corner on the CTA website provides resources to local chapter treasurers including links to download the Treasurer’s Handbook and recorded sessions of past treasurers trainings – member login is required. To request for affiliate support, please contact Anna Dilig in the CTA Accounting Department at adilig@cta.org or (650) 552-5262.

Back to top----------

Helpful Questions and Answers

1. What insurance coverage is automatically provided to CTA chapters and UniServ Units?

- The General Liability Insurance policy ($1 million Each Occurrence $2 million Annual Aggregate per location) covers claims of negligence brought by third parties against you or your local chapter alleging bodily injury or property damage arising out of a CTA activity.

- The NEA Fidelity Bond Program insures your local chapter against fraud or employee dishonesty resulting in money or securities loss.

- The NEA Association Professional Liability Insurance policy protects your local chapter against the financial loss for liability incurred while conducting authorized association activities.

- The NEA Educators Employment Liability Insurance policy provides liability and defense cost coverage for civil suits brought against a CTA member during the course of employment. It also covers the legal defense cost for criminal charges, provided the CTA member is exonerated or the charges are dismissed.

2. What coverage do I need if my chapter or UniServ Unit owns its building?

If a local chapter or UniServ Unit owns its own building, they should purchase a property insurance policy to cover the replacement cost value of the building (including losses caused by building laws) and an office contents policy to cover office equipment, improvements, etc. the chapter owns.

Additionally, we recommend that the chapter purchase Extra Expense coverage which will provide coverage for additional expenses you may incur in the event you will need to lease or rent temporary office space while your premises is being repaired or replaced. If you lease space to others, purchase Loss of Rents coverage.

The chapter or UniServ Unit should also purchase a comprehensive commercial general liability policy.

3. What type of insurance is not provided by CTA and is the responsibility of my local chapter or UniServ Unit?

Each chapter or UniServ Unit should determine which insurance policies they need to purchase beyond those provided by CTA for CTA related activities. For example, if a chapter hires employees, such as a secretary, purchase Workers’ Compensation insurance and Employment Practices Liability insurance. If a chapter or UniServ Unit owns office equipment such as furniture, computers, and tenant improvements, purchase Business Personal Property insurance. Purchase General Liability insurance if you have tenants or plan any non-CTA related activities. Please see the section Chapter Insurance Options for more information.

4. If I need to provide proof of CTA's General Liability Insurance, how can I obtain verification?

Contact CTA’s Risk Management Department at RiskManagement@cta.org. To obtain a copy of the CTA General Liability certificate of insurance, click on Chapter Insurance under Tools & Resources at www.CTAMemberBenefits.org.

5. My local chapter is planning a special event that is CTA related and we were asked to add a third party as an Additional Insured to the CTA General Liability policy. How is this done?

To add another party as an Additional Insured, please contact CTA’s Risk Management Department by emailing RiskManagement@cta.org. There may be a fee for this service.

6. If I hire my own employees, why do I need to purchase Employment Practices Liability Insurance?

As an employer, you may be held financially liable in the event of a lawsuit alleging discrimination, sexual harassment, or wrongful termination as well as other common employment related violations. Even if your chapter hires only one employee, the risk exists and it is important to consider the purchase of Employment Practices Liability coverage.

7. Who do I contact if I need a Sabbatical Leave Bond?

Please contact Huong Tran, Account Manager, Alliant Insurance Services at (408) 315-0638 or via email at Huong.Tran@alliant.com.

8. If I drive my own vehicle for CTA business and I am involved in an accident that results in an injury to another person, am I covered under CTA's Business Automobile Liability Insurance policy?

No. CTA's policy would not provide coverage for you personally in this case. CTA encourages you to verify coverage under your personal automobile policy for "business use". The CTA Business Automobile Liability policy is a commercial business policy, it provides coverage to the local chapter, UniServ Unit and CTA.

9. What if one of my chapter members is in an auto accident using their personal vehicle while on CTA business, resulting in bodily injury to another person, and the local chapter, UniServ Unit and/or CTA is named in a lawsuit?

The CTA Business Automobile Liability policy provides coverage to the local chapter, UniServ Unit and CTA on an excess basis (above the employee’s own insurance coverage). The chapter member must rely on their own coverage.

10. If someone is injured while in a chapter office or UniServ Unit, whom should I contact?

If the individual requires medical attention, immediately contact 911 and then notify CTA’s Risk Management Department at (650) 552-5200 or RiskManagement@cta.org.

11. Is there a deductible under the NEA Fidelity Bond?

This policy, underwritten by National Union Fire Insurance Company, has no deductible for the Labor Organization Bond, $500,000 per loss deductible in place for the Employee Dishonesty policy and a $1,000 per loss deductible for the Crime policy. The $500,000 deductible for the Employee Dishonesty policy is met through the underlying primary Labor Organization Bond policy.

12. Is there an exclusion in the General Liability Policy for liquor?

Generally, claims arising out of the serving of liquor at a function are covered under the CTA General Liability policy. However, there is a liquor liability exclusion if you are in the business of manufacturing, selling, serving, or distributing liquor (entry fees, “donations” for drinks, etc. may trigger the exclusion).

Serving liquor at a chapter or UniServ Unit function should be carefully reviewed due to an increase in potential liability exposure. If liquor is served at a chapter or UniServ Unit function which is a catered event, it is strongly recommended that the caterer furnishing the liquor be properly licensed and provides the chapter and CTA with evidence of liquor liability insurance, naming the chapter and CTA as Additional Insureds; plus, such coverage be issued in an amount of no less than $1,000,000 per occurrence. We recommend that chapters take all reasonable precautions and provide transportation to those unfit to drive. Contact CTA’s Risk Management Department at RiskManagement@cta.org for strategies to minimize potential liquor liability claims.

Back to top----------

----------

Glossary

Additional Insured: A person, other than the named insured, who is protected by the policy, most often in regard to a specific interest (e.g., a landlord that asks to be added to a liability policy).

Aggregate: The maximum insurance coverage under a liability policy during a policy period regardless of the number of losses that may occur.

All-Risk Insurance: Insurance that covers all perils (risks) of loss except those that are specifically excluded. Sometimes referred to as “special perils”. Common exclusions are earthquake, flood, wear & tear, nuclear, and war.

Bodily Injury: Physical harm or impairment to a person.

Breach of Duty: The failure or omission to do that which a person is bound by law to do. Occurs when a person’s conduct fails to meet an applicable standard of care. It is also considered negligence.

Business Automobile Liability: Liability coverage for the named insured when members or chapter leaders use their own vehicles for business purposes on behalf of the insured.

Certificate of Insurance: Written evidence that an individual or group is covered as an additional insured on the liability policy and to set forth its basic terms. This is not a legal document, nor does it change the insurance policy on which it is issued. Note: Certificates don’t always specify the holder as an additional insured but is more evidence of Insurance that may or may not include the AI language.

A certificate of insurance (COI) is a document issued by an insurance company or broker. The COI verifies the existence of an insurance policy and summarizes the key aspects and conditions of the policy. For example, a standard COI lists the policyholder’s name, the policy’s effective date, the type of coverage, policy limits, and other important details of the policy.

Civil Suit: A lawsuit against an individual for monetary damages or injunctive relief.

Contractual Liability Insurance: Coverage for losses arising out of liability assumed under an insured contract.

Criminal Charge: An accusation of criminal law violation that can lead to punishment.

Deductible: The amount deducted from a loss that the insured is required to pay.

Directors’ and Officers’ Liability: Affords protection to Board Members, Directors and Officers for liabilities arising from activities connected with serving the organization. Directors and officers (D&O) liability insurance protects the personal assets of corporate directors and officers, and their spouses, in the event they are personally sued by employees, vendors, competitors, investors, customers, or other parties, for actual or alleged wrongful acts in managing a company.

Excess Liability Coverage: Liability coverage that is written in excess of the primary liability insurance policy. It is designed to increase the limits of liability.

Fidelity Bond: A bond covering an employer or association for a loss resulting from employee theft of employer’s money and securities.

Hired Automobile Liability: Liability arising from the insured renting or borrowing vehicles for short periods of time. Coverage is “excess” of the amount of liability insurance provided by the rental company or vehicle owner.

Indemnify: To reimburse an insured for a loss.

Insured: A person or organization who has purchased an insurance policy and is protected by it.

Intentional Act: A deliberate act or omission.

Liability: An actual or potential legal obligation or responsibility to another person.

Libel: An untrue, defamatory written statement; a published writing that harms another person’s reputation, business, or livelihood.

Liquor Liability: Liability arising out of manufacturing, distributing, selling or serving alcoholic beverages. Liability can arise by contributing to the intoxication of an individual.

Medical Payment: Payment to the insured or others who are injured without regard to liability.

Named Insured: An individual, business or organization that is specified on the insurance policy.

Neglect: To disregard, leave undone, or fail to give proper attention or to be careless.

Negligence: The failure to exercise the care of a reasonably prudent or ordinarily careful person.

Per Occurrence: A limit in the insurance policy that caps the payment of all claims that arise from one single event.

Personal Injury: Wrongful conduct causing false arrest, wrongful eviction, violation of a person’s right of privacy, libel or slander of a person.

Primary Liability Insurance: The first policy applicable to a liability claim.

Property Damage: Destruction or damage to property.

Property Damage Liability: Insurance coverage that defends and indemnifies the insured and pays claims of an individual or company (third party) for damage to their property caused by negligence of an insured.

Sabbatical Leave: A teacher’s paid leave of absence used for travel or research.

Slander: Oral defamation; a spoken statement or gesture that harms someone’s reputation.

Workers’ Compensation: An insurance policy that covers work-related employee injuries or disease while the employee is on the job. State law requires that all full and part-time employees be covered under a workers’ compensation policy.

Back to top----------